It appears as two consecutive peaks of approximately the same price on a price-versus-time chart of a market. The price level of this minimum is called the neck line of the formation. The formation is completed and confirmed when the price falls below the neck line, indicating that further price decline is imminent or highly likely. With the two swing highs ending at roughly the same level, that level becomes a resistance level. A line joining the swing low to the preceding swing low constitutes a neckline, which serves as a support level.

After the buyers tried to return the quotes to the first local high, the sellers became more active in the market. Let’s analyze the pattern in more detail using XAUUSD as an example. After the formation of the first top, the price began to decline. Each trader observed in the chart a figure in the form of the letter M called double top. The distinctive feature of this pattern is that the quotes reach the horizontal resistance level twice. Additionally, a trough is formed between the two peaks as a short downward correction.

Double Top Pattern Meaning

However, this recommendation is overlooked when the pattern forms. When the price reaches the resistance level, the traders of the second and third waves normally have a loss on their open positions, and they have nothing else to do but to close them. As a result, the quotations test the resistance level, start growing and change the trend.

A double top pattern forms in the zone of high prices and looks like the letter M. A double bottom pattern formation occurs in the zone of low prices and looks like the letter W. The appearance of a pattern in the chart means that the price has reached a maximum and is ready for a reversal. It is very important that all the criteria for constructing a pattern in the chart are met. Especially when opening short trades after the breakout of support at its lowest point. As with trading other patterns, Double Top trading has its limitations.

Understanding the Head and Shoulders Pattern

Bull traps often occur at resistance levels, causing traders to open long positions. The bears managed to reverse the price down after the second local high and break out the support level. There are so many stocks in which this chart pattern is formed and it is difficult for traders to look at the charts of more than 500 stocks for finding this pattern. Double top patterns are considered a “bearish reversal pattern,” i.e. a pattern created before a downward reversal after an upward trend. Patience and finding the critical support level are of great importance.

Trading Double Tops And Double Bottoms – Investopedia

Trading Double Tops And Double Bottoms.

Posted: Sat, 25 Mar 2017 18:10:00 GMT [source]

Setting a target price while using a double top pattern is relatively easier. While you are analyzing the stock trend through any chart, just measure the size of the complete pattern. The double top pattern is similar to the triple top pattern and differs in terms of the number of resistance retests involved. To avoid losing money, it is prudent for traders to look for a good double top reversal by considering known rules.

When to open a Sell order

When looking at the volume, it is beneficial to note that the buildup of the price level reached on the first peak can be attributed to increased volume. The fall to the neckline occurring thereafter can be attributed to low volumes. The second attempt leading towards the second peak should also be on low volume levels. When the traders notice that the prices are not rising beyond the level reached by the first top, the bears or sellers may then begin to dominate, and it begins to lower price levels. Should the prices drop beyond the valley, it is generally a bearish signal.

You can purchase the code together with lots of other code from our free and profitable trading strategies. You estimate the profit target by measuring the height of the pattern and projecting it downwards from the neckline. The stop loss can be in the double top pattern rules middle of the pattern, which offers a better reward/risk ratio, or above the pattern, which offers a poor reward/risk ratio but appears safer. From the chart above, you can see that the price was in an uptrend, as indicated by the blue arrow trendline.

What does M pattern tell the traders?

The price reached a peak and pulled back to the neckline (yellow line), and then started to rally again. It got to the level of the first peak and was rejected twice before it eventually declined to the neckline and broke below it. Once you have identified this chart pattern in the stocks, you can trade accordingly as discussed above. Double Top resembles the M pattern and indicates a bearish reversal whereas Double Bottom resembles the W pattern and indicates a bullish reversal.

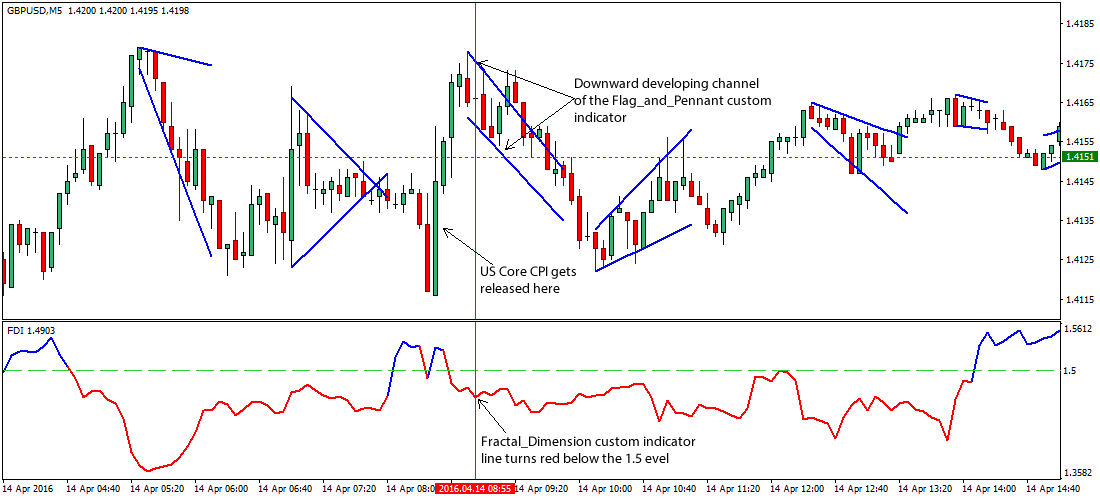

- Nowadays, to trade a chart pattern successfully, you need to make a strategy with the addition of filters.Without a strategy, a chart pattern will not make you a profitable trader.

- The Web Sites makes chat rooms, forums, message boards and/or news groups available to its users.

- The major objective refers to the level of a market at which it may be possible to obtain an increased level of sell or buy orders.

- The supply-demand balance then reverses; supply outpaces demand (sellers predominate), causing prices to fall.

- To reconfirm the formation of a double top pattern, the trader may also estimate a potential market move once the formation of a double top pattern is spotted.

The formation is completed and confirmed when the price rises above the neck line, indicating that further price rise is imminent or highly likely. Before opening a short trade, wait for a breakout of the neckline and make sure that the price reverses. After an unsuccessful attempt by buyers to raise the price above the trough, open a short trade. (78.55%) – One of the most frequent patterns for price reversals is the double top/bottom. A double bottom is formed by two nearly equal lows, whereas a double top is defined by two nearly equal highs with some space between the touches.

It is a common occurrence towards the end of a bullish market when the price rises. Much like the double bottom pattern, the double top pattern is mostly used to identify a trend reversal at the end of the previous market trend. This is because forex traders who use a double top pattern look for a trend reversal pattern, which usually is easier to identify at the end of an uptrend. The slowing momentum and price consolidation near the second peak typically indicate a bearish trend reversal.

- You may see this test resistance multiple times before the price breaks downward.

- These patterns are often used in conjunction with other indicators since rounding patterns in general can easily lead to fakeouts or mistaking reversal trends.

- The image below illustrates the double top breakout, and the breakout confirmation trigger.

- One great criticism of technical pattern trading is that setups always look obvious in hindsight but that executing in real time is actually very difficult.

At that level, sellers come into play and make the price retrace downward. Due to overbought and resistance levels, the number of buyers decreased. https://g-markets.net/ This pattern appears so often that it alone may serve as proof positive that price action is not as wildly random as many Traders claim.

Double Top

Now, before moving any further, it is vital to first understand what a bearish reversal is about. It occurs at the end of an uptrend and indicates a fall in the price, which means that the sellers will take over the buyers. With a decrease in the price, the traders would sell their stocks in the market. Looking at the charts on history, we may note that this does not necessarily happen, and the trend may reverse without special patterns. The double top pattern is incomplete until a valid neckline breakout happens. Because the trend will remain bullish and the price has the ability to break the resistance zone until a valid neckline or support zone breakout.